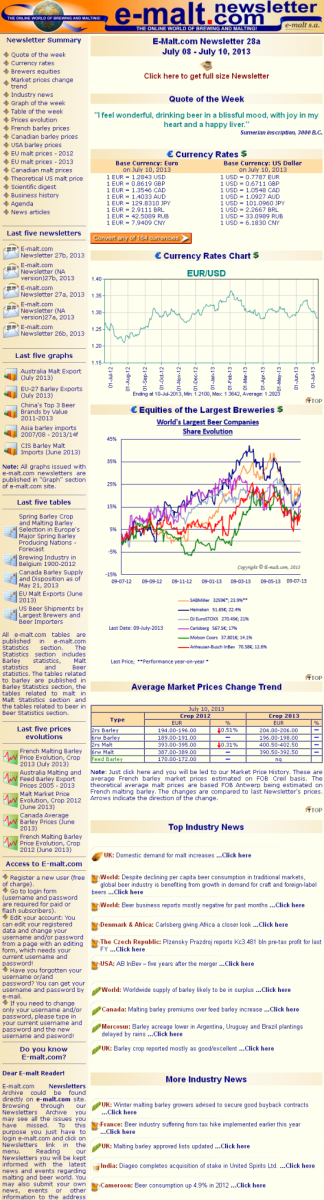

Despite declining per capita beer consumption and relatively flat volume growth across traditional North American and European markets, the global beer manufacturing industry benefited from phenomenal growth in higher-value craft and foreign-label beers during the past five years, the latest Global Beer Manufacturing industry report by IBISWorld states.

At the same time, rising disposable incomes and consumers shifting from locally produced, subsistence products to higher-quality, attractively branded beer underpinned rising beer consumption and strong volume growth in emerging markets. Consequently, although a dip in disposable income in 2009 resulted in a slight decline that year, industry revenue grew an estimated 3.6% per year on average to $141.7 billion in the five years to 2013. This growth includes an anticipated 3.2% increase in 2013 as brewery marketing and distribution expansion efforts pay off in emerging economies.

“The industry has undergone significant consolidation during the past five years,” according to IBISWorld industry analyst Agata Kaczanowska. In late 2011, for example, SABMiller snared Australian brewer Foster’s Group and in 2013 AB InBev acquired Grupo Modelo. Heineken and Carlsberg jointly acquired Scottish and Newcastle before splitting its global assets. Other major players, including Ambev and Japanese brewers Asahi and Kirin, have also been busy, expanding via acquisitions and investments in new facilities.

Industry consolidation during the past five years was driven by M&A activity as well as distribution network expansion by major companies. For example, SABMiller made a major acquisition during 2011 by purchasing Australian brewer Foster’s. As the opportunities for growth in mature economies diminish, merger activity is expected to continue to increase during the next five years. Opportunities for organic growth are limited in many domestic beer industries as beer consumption is already relatively high. Thus, many companies are looking to grow their businesses through acquisition, investment in breweries in emerging countries or merging to take advantage of cost synergies.

Conditions in the global beer manufacturing industry are forecast to strengthen from 2014 onward, underpinned by renewed demand for higher-value imported and craft beers in developed nations, strong volume growth and rising beer consumption in developing nations. “The spate of consolidation in the past five years will aid stronger growth,” says Kaczanowska, “with the top four brewers boasting extensive portfolios of brands covering all global regions and privileged access to burgeoning markets in Latin America, China and Eastern Europe.”

http://www.e-malt.com/Publications.asp?9888

No comments