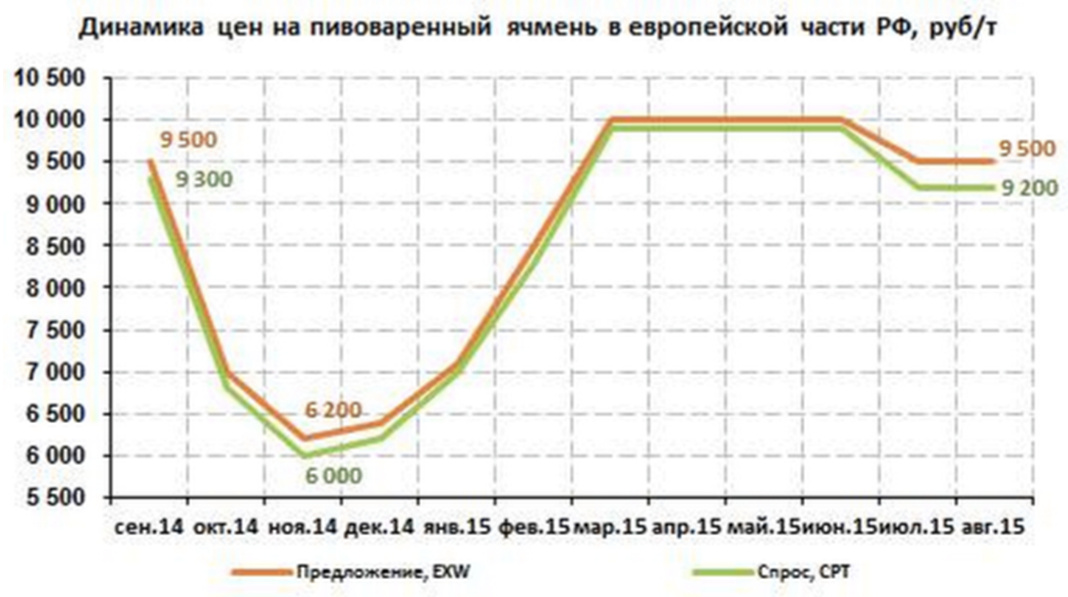

Harvesting campaign of malting barley in Russia has been finished in most of regions and a number of grain proposals in the market have increased greatly. But prices of the new crop began rising from the second month of 2015/16. It was due to high demand and a volatile situation in the exchange market. Detailed information about season start is given below.

European part of the country

In the run-up to 2015/2016, there was a price calm in the malting barley market. Trading and purchasing activity weakened and the major part of operators were waiting for a season start and price cutting. It bears noting that price stability was supported by high quality characteristics of the crop 2015 and lack of raw materials.

The first negative factor was weather deterioration during harvesting. Heavy rainfalls in July led to the development of diseases and microorganisms and a high moisture level resulted in grain post-harvesting and as a consequences – a price jump at the beginning of 2015/16. So, agrarians preferred to suppress sales of large lots of the new crop, conforming to GOST and quality standards. However, they activated sales of low quality grain for 8200-8500 rub/t EXW (8800-9400 rub/t EXW – high quality barley). As for consumers, they showed a tepid interest to malting barley, giving preferences to the crop 2014 due to its high quality characteristics.

Price dynamics for malting barley in the European part , rub/t

Supply, EXW Demand, CPT

Alexander Mordovin, the President of Barley, Malt, Hops & Beer Union (Russia):

“This season, malting barley production volumes are estimated at last year’s level. In most of regions there are no changes in the acreage. It is early to speak of yield parameters, as we are estimating average yield in all regions, but harvesting campaign in the West-Siberian region has just started. In total, I suppose that average basic barley yield 2015/16 (aggregate yield of feed and malting barley) will be near 20-22 dt/ha in Russia. Besides, the acreage of malting barley was 1,5 mln.ha. Farms in the Central Black Earth Area, Tula, Bryansk and Ryazan regions, specialized in malting barley cultivation, are exceeding basic yield data to 2-2,5 times and in certain regions of the Central Black Earth Area yield characteristics are over 50 dt/ha.

According to estimates, quality parameters of malting barley 2015 are below last year levels due to the fact that the Central Black Earth Region, the key grain producer for malt and brewing industry, suffered from heavy rainfalls influenced on germination. Besides, if the moisture level of the grain is high, it requires redrying, so it will have an impact on quality and final prices.

Despite the prime cost of malting barley, its profitability shall be supported by stable demand. Firstly, it is related to the fact that purchasing of foreign malting barley is unprofitable now and, taking into account the delivery to the harbor of Saint-Petersburg, the price of imported malting barley will be 15000 rub/t. So it will lead to the price jump for high quality malting barley in Russia, but the prices will not be high, as quality parameters required by local brewers and maltsters were reduced for protein content and germination, so as a result, volumes of useable grain will increase. Bu,t despite an obvious price advantage of Russian malting barley, imported supplies will be made due to necessity of “blending” and improving of Russian malting barley quality.

As for price tendency, they will be raised and reach 12000 rub/t by spring 2016.”

In the middle of August, prices began changing in the European part of Russia. It bears noting that due to unstable situation in the exchange market, agricultural producers were ready to offer small lots for ex-work overprices. On the contrary, representatives of malt companies increased raw material consumption and had to drive up prices to 10000-10200 rub/t., including delivery. Besides, export companies paid interest to crop purchasing on CPT basis, as evidenced by price increase to 10500 rub/t. CPT. Besides, many traders could offer higher ruble prices, taking into account stable foreign export prices, due to devaluation of the ruble.

By opinion of market operators, small price stabilization at the beginning of September is just ‘time out” before a dynamic malting barley price hike. And by the end of the calendar year, prices for high quality crop can reach 11000-12000 rub/t CPT.

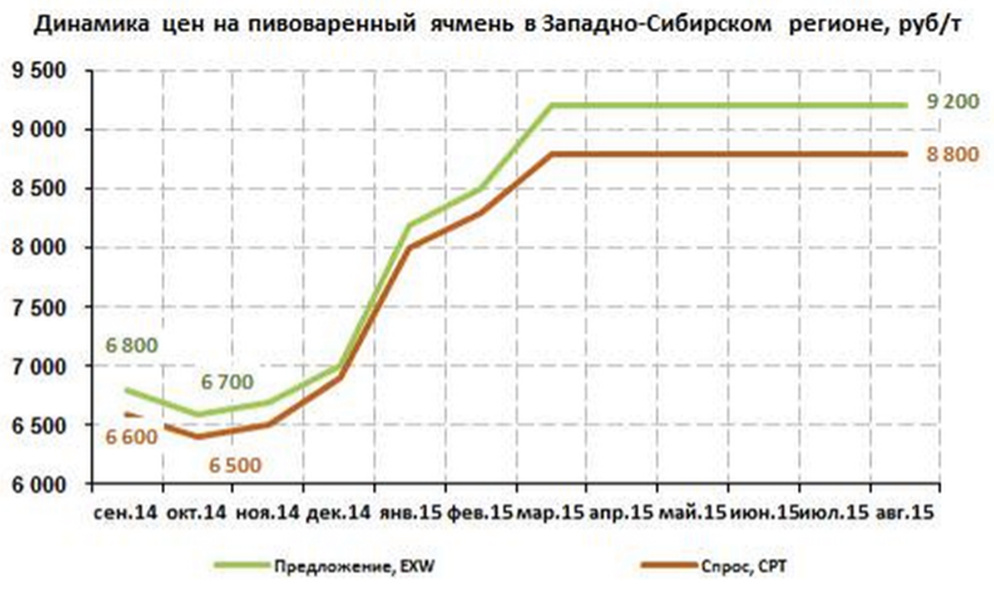

West-Siberian region

As for West-Siberian region, prices for malting barley in July-August have not dropped significantly due to delayed harvesting campaign and lack of grain proposals. During this period, prices were declarative ((9000-9200 rub/t EXW and 8800-9000 rub/t СРТ) and often have not been confirmed by agreements. New crop appeared in the beginning of September for 8000-9000 rub/t EXW. Besides, many market participants informed that volumes of the crop 2015 were minimal and quality parameters were low. Currently, harvest works are delayed due to heavy rainfalls. Many consumers suppose that the region will face with low quality grain this season and it will lead to a rapid price increase for malting barley.

“This season quality parameters of malting barley 2015 lowered. Basically, there is feeble grain in the market. Besides, three key parameters: protein, kernel size and germination energy became worse. Unfavorable weather conditions during sowing and harvesting couldn’t provide good germination and coarseness. At this stage, agricultural producers prefer to suppress sales of large lots, waiting for price hike due to activation of malt and brewing companies,” – market participant from the Altai Territory noted.

Price dynamics for malting barley in the West-Siberian region, rub/t

Supply, EXW Demand, CPT

Market participants’ expectations

In conclusion, you might say that in 2015/16 malting barley prices will be rather high. Market participants suppose that lowering of quality characteristics can lead to raw materials shortage for malt production. Besides, changes of the ruble rate against the U.S. dollar, supply-and-demand balance will influence greatly on the price situation over this season.

No comments