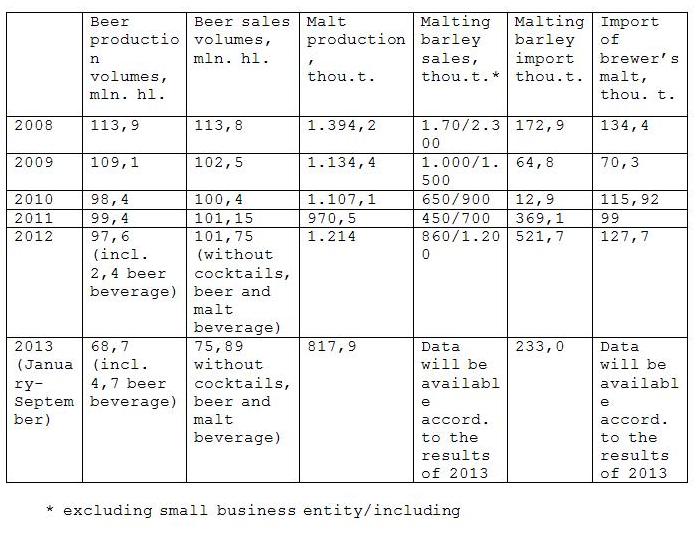

In order to understand processes and influence of the legislative changes, occurred in the production chain «malting barley – beer» and taking into account your questions to the Press office, our Union collected all statistical information according to the activity of the industry (barley, malt and beer) over a period of 2008-2013 (data for 2013 are given in a period of January – September).

More detailed information for the members of the Union (a fiscal month/region) is available upon the request to the Press Office.

We’d like to ask only two questions according to the statistical data.

The first question:Does increasing of excise duty rate influence greatly on beer production volumes in Russia

An answer: In 2007 beer production volumes in Russia were approximately 115, in 2008 – 114, in 2009 – 109, in 2010 – 98, in 2011 – 99, in 2012 – 98 million hectolitres. You’ll remember that excise duty rates have been increased from 3 to 9 rubles since January 1, 2010. Beer production in 2010 obviously declined to 10,1% but in 2009 it dropped to 4,4% compared with 2008. A still more confusing situation occurred against the background of the stability of beer sales volumes parallel to the further increasing of excise duties in the following years. In 2009, 2010 and further beer sales haven’t dropped being on the level 100 million hectoliters per year.

Also in 2013 beer sales don’t come down (according to the statistic data for January – September, a sales figure was 76 million hectoliters. It will result in the same annual amount – 100 million hectoliters by comparison with previous years). But a real decrease of sales volumes took place only in 2009 – over 10%.

It should be noted that in 2009 excise duties weren’t raised. And at that time The Federal Service for Alcohol Market Regulation was in the process of creating and couldn’t influence on the activities of the industry.

Based on the estimates of the growth of beer consumption in 2007 and 2008 the representatives of the industry produced “extra volumes” and slowdown in sales compounded matters. However neither excise duty growth nor the establishing of the Federal Service for Alcohol Market Regulation had an impact on beer sales.

There is one moment that alarms the members of the Union. Declared beer production volumes over the period of January – September 2013 drop behind real sales volumes approximately by 10%. If at year-end this difference is kept a “shadow beer market” will occur in Russia. Our Union warned of this http://barley-malt.ru/?p=5742 and it will come to increasing of the legislative pressure to beer producers.

The second question: Does imposing of legislative restrictions on using of unmalted cereal products and sacchariferous components in beer production influence positively on malt and beer production volumes in Russia?

An answer: mentioned limits (minimal using of malt was increased from 50% to 80%) came to force from July 1, 2012. It led to the sharp growth in consumption and production of malt. In 2011 malting companies produced 970 and in 2012 – 1.214 thou. tons of malt. An increasing was impressive and accounted for 21%. And malt production figures 818 thou. tons over the period of January – September will surely show the same value or even higher than in 2012. So changes in legislation caused to raise malt production and according to the statistical data hadn’t influenced on beer sales volumes.

What’s happening in Russia: we observe very interesting and phenomenal process of repartition of a sphere of influence in the industry where Russian independent brewing business wins back lost positions becoming the powerful rival for transnational brewing companies forced to close down plants and accusing legislative and executive powers of all troubles.

However, we’d like to warn the representatives of the Russian independent brewing industry against early “Dizziness from Success”. Under external reasons it’s impossible to accuse transnational companies of default in excise duties payment and negative response of the government for appearing the “beer shadow market” will be directed to Russian independent brewing companies. Besides, any possible restrictions like introducing of special requirements to the storage facilities, manufacturing authorization, emerging of excise stamps, PET-containers ban will hit the independent brewers greater than their colleagues – transnational brewing companies.

And the common problem of the industry for the foreseeable future is foreign beer supply growth. High prime costs and great risks in beer production in Russia are following to the increase of aggregate expenses for beer producers. WTO accession in 2012 will lead to zeroing of the customs duty for imported beer and after that a competitive battle with acceptable quality imported beer at wholesale price not exceeding 10 rub/bottle will be very significant. Forthcoming introduction of “parallel imports” will greatly hit Russian producers of licensed beer.

No comments