In this analytical article, addressing issues of excise taxation of brewing and wine products, we’ll try to make a retrospective journey into the history of this question, realize importance of mistakes made in past by our foregoers and politicians in order to avoid reoccurrence because any way you slice it “experience keeps a dear school, but fools learn in no other”.

As an introduction, we’d like to cite an opinion of the Medical Board and a representative, an academician A.Ya. Danilevsky (according to the request of the Ministry of Finance), 1904.

A question of the Ministry of Finance:

Shall beer be classified as strong intoxicating and harmful alcohol drink? Does beer influence on body as a poison and cause any diseases?

An opinion of the Medical Board:

High vodka strength has intoxicating impact on human body, with rather small amount of consumed drink. But intoxicating role of beer depends on quantity of consumed as well as sex and a level of addiction.

Intoxicating role of beer as a strong drink appears only in case of excessive alcohol intake. Beer brands with alcohol content less than 4%, play a dietetic role towards human body. If a consumer is an adult male, light beer brands can be classified as unintoxicant in case of moderation in the use of alcohol. Beer has nutritive properties, so as a dietetic product, it merits reward rather than blame.

Besides its dietetic characteristics, beer shall be classified as least harmful and dangerous and serve against fatal role of vodka.

Beer with alcohol content less than 4% is harmless and even useful according to its dietetic characteristics.

All questions of the Ministry of Finance and answers of the Medical Board are available by reference.

Today we can only smile at that historical conflict between beer and vodka and be sure that we has chosen right direction, dividing beer to two groups (below 4% of alcohol and over). But our aim is to collect historic materials and study experience of our foregoers.

All gathered information will be sent to the Government Commission for Competitiveness and Regulation of the Alcohol Market, the Federal Service for Alcohol Market Regulation and the Ministry of Finance of the RF.

Russian chronicles contain information about using of hop beverages in Russian olden times known to the Slavs. Beverages were made not only from bread materials (home brew and kvass) but from honey. A Russian historian N. Ya. Aristov mentioned that “anciently, the Russians could grow malt used for beer brew” and in olden times, popular drinks were kvass, honey and beer”.

In natural economy conditions, prevailed in ancient Russia, beer, home brew and honey were made for own needs. There was no industrial production. Vodka came to Russia only in XVI century.

Giosafat Barbaro, describing his travel to Muscovy in 1439, has also noted about popularity of beer and honey: “Russian people don’t drink wine, they brew a special beverage from honey or wheat, adding hop followed by fermentation and as a result you can get drunk as if from wine”.

In XV century, circulation of such beverages pushed Russian princes to source income to the treasure by way of fixing hop and malt duties. People could brew beverages freely, paying duties and honey tributes. Bu this free right to brew beverages for own needs existed only in the earliest period of Russian State creation.

Independent brewing craft appeared in Russia very early. Beer domestic industry with location in separate units dated back to XII century. Later, with growing of domestic markets, it obtained a wide circulation.

Compared to different food crafts, brewing production was limited at early stages. Using of hop drinks as source of income, drove out free beer production.

Tatar invasion period was characterized by full prohibition of hop drinks. After overthrowing of Tatar Yoke, Moscow princes also prohibited private persons to sell hop beverages. After prohibiting of private brewing, taverns appeared and owners of these taverns paid taxes. Then princes possessed their own taverns, pursuing free owners. During the reign of Ivan III, wine production became government monopoly.

In order to provide income flow, it was prohibited to brew beer and honey at home. Only boyar children, first noblemen and military men could brew beer.

Different sources contain information about great volumes of beer production and consumption at the end of XVII century. But vodka spreading influenced negatively on Russian brewing industry. (in 1705 a tax farming was introduced).

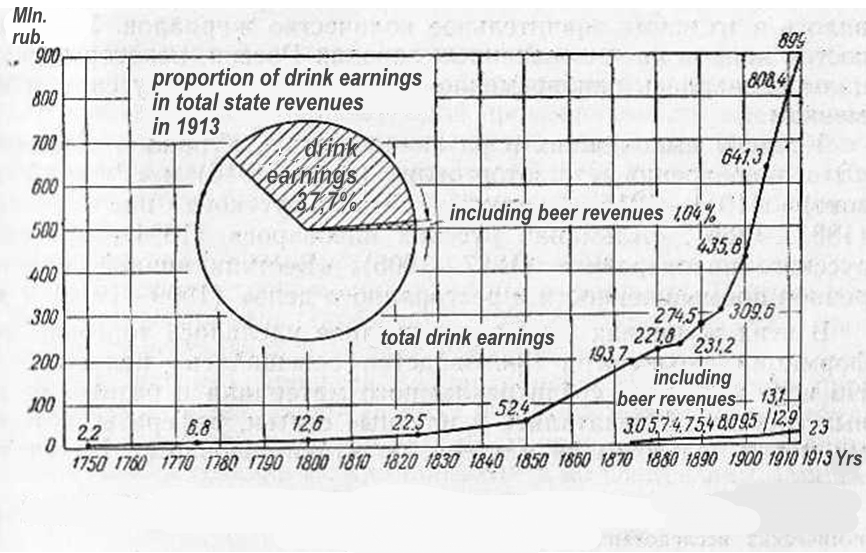

Drink treasure earnings have been increasing at reckless speed and according to estimates of a professor Kitarry, earnings increased 335-fold. Statistics of the Czarist Ministry of Finance from 1750:

|

1750 |

2666 |

th. rub. |

|

1800 |

12622 |

th. rub. |

|

1850 |

52443 |

th. rub. |

|

1863 |

113700 |

th. rub. |

Thanks to drink earnings, treasure revenues were 31% of the total amount of the government revenue in 1863.

The system of farm taxes and monopolies was the largest source for accumulation of money by boyars and traders. And a competition between two industries – distillery and brewing stepped forward.

Brewing industry declined during the period of farm taxes. The level of beer consumption was rather small, besides, merchants and aristoi bought beer abroad. During the reign of Catherine II, import of English beer increased. Import of porter ran high from 19,6 thousand rub. in 1749 to 368 thousand rub. in 1792.

In 1817, porter shops has increased from 70 to 736 for two years; brewing plants – to 877. It was a brewing prosperity phase.

But return to farm taxes in 1827 limited beer production and sale again. Brewing production began declining and by 1848 it has stopped in 19 provinces. Beer consumption in Moscow, raising in the first half of XIX century to 2 million buckets, reduced to 75% – 484 thousand buckets by 1856.

Situation in the brewing industry worsened. Troubles caused by tax farmers, restriction of domestic brewage, interests of landlords and government monopoly – all these factors were focused on fast growing vodka production.

Over the last 15 years, vodka production increased (from 1843 to 1859) from 16,1 mln. buckets to 51,7, so, more than threefold.

Before introduction of excise system (1863) there were 2190 brewing plants at the territory of Tsarist Russia located only in the European Russia. 53,5% of plants with small capacity produced approximately 5000 dL. per year. 45,6% of plants – 50 000 dL. and over 50000 – 0,9%. In other words, there were near 20 middle-capacity plants and only 5 large factories (in Moscow, St.-Petersburg, Warsaw and Riga).

In 1863 a new excise system was introduced and it has been operating till 1914. This system was directed to free alcohol trade and taxation of beer, vodka production and patent fees.

Treasure revenues continued to grow steadily. Drink earnings increased from 113,7 million rub. in 1863 to 309,6 million rub. in 1895. So, industrial country advance, got free of serfdom, town growth and favorable excise conditions resulted in brewing industry development.

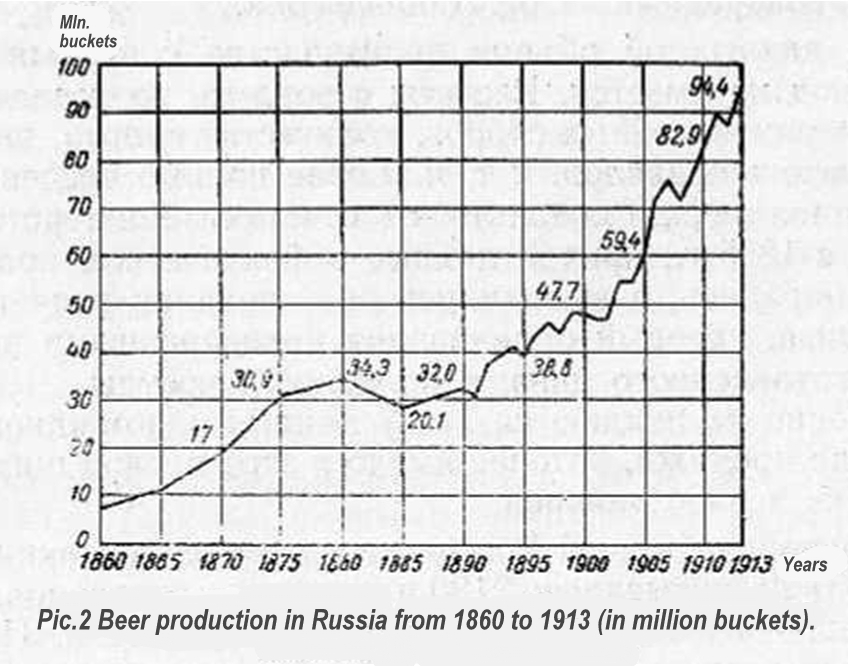

According to the figure, beer production quintupled during two decades (1860-1880). Further decline after the eighties is explained by the deepest economic doldrums in 1882-1886 and beer tax hardening.

If a bucket of vodka cost 5 rub. and beer – 1 rub., proof spirit in vodka was 12,5 kop. and in beer – 25 kop., so double the price.

From 1887 beer production began growing and it was followed by integration of brewing plants. So, industrial capitalism in Russia at the end of XIX century contributed to rapid development of the Russian manufacture.

Datasheet shows that quantity of brewing plants dropped during 30 years (1865-1895) doubly and then hardened with small deviation. In 1900, 24 plants (2,2% of the total amount) produced 44% of all beer, including 7 plants, producing 1 mln. buckets/per each. It points to the fact that even in those years, largest plants dominated.

|

Years |

Quantity of brewing plants |

Production in thousand buckets |

Average output per one plants in thousand buckets |

|

1865 |

2284 |

11100 |

4,9 |

|

1875 |

2070 |

30965 |

15,0 |

|

1885 |

1541 |

28243 |

20,7 |

|

1895 |

1066 |

38790 |

36,4 |

|

1900 |

981 |

47737 |

48,7 |

Beer excise levy differed. Firstly, technological equipment was liable to tax – excise duty was collected according to aggregate capacity: mash mixing vessels and kettles, according to quantity of produced mash and brewing period. It was thought that one forth of malt was required for 20 beer buckets; 22 buckets of mash-mixing vessel capacity was required for one forth of malt; volume of kettles and other technological equipment was half of mash vessel capacity. So, amount of excise duty for one mash – 9 kop./bucket, for two mash – 18 kop./bucket per day.

These excise system balked technical progress. Fixed excise tax for all technological equipment closed the door on use of non-core technological equipment liable to duty. In 1864 the system was amended and non-core equipment was free from tax.

As of amount of excise levy, Russia came first – 20,8 kop./bucket, taking into account original gravity of the wort 12,5%. The total excise amount due to low production level was rather small: in 1885-1890 it was 5-5,5 mln. rub and from 1895 it grew from 8 mln. rub. to 23 mln. rub in 1913. As compared with vodka it was a trivial sum.

Beer excise system led to irregularities in brewing procedure and quality deterioration. Brewers began making thick mash per sixteen kg. of malt in order to reduce excise fee and then diluted it with water in the filter vessel. Mash thickness, barring from the normal technological process and saccharifying, led to low quality beer. From the other hand, mash thickness delayed the process of wort filtering in the vessel and as a result, wort lost its key characteristic – flavor. Brewers added much sparging water. So, the law prohibited diluting beer with water and brewers began diluting wort. All these factors led to lowering of beer quality.

Tax treatment was fatal for production. As excise tax was collected for every mash, it was required to file application to the inspector for getting one-time license. If the plant was not in operation, technological equipment was sealed. Mainly, small plants suffered from this excise procedure. More advantageous position of large plants resulted in production concentration.

In 1895 excise system was reformed to the state wine monopoly operating till 1914. This system had two reasons: to support large landowners and to increase treasure revenue.

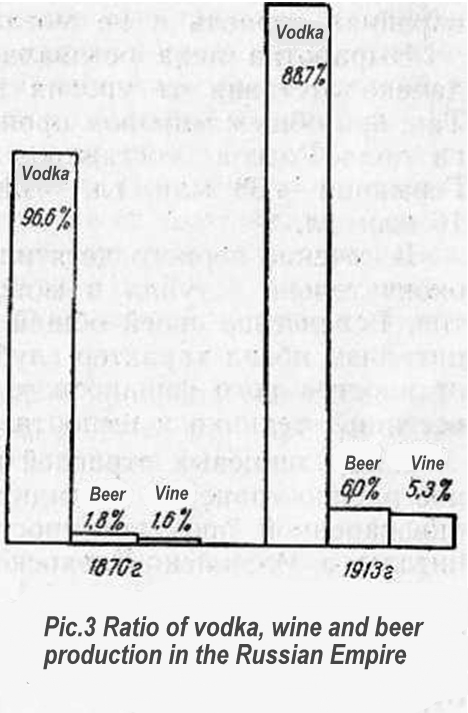

Monopoly secured an exclusive right of the State to sell alcohol, wine and vodka products. Treasure earnings began increasing rapidly; Russia was the first according to drink earnings. According to ratio of vodka, wine and beer production in the Russian Empire, the dominant place in alcohol consumption was given to vodka.

The following diagram illustrated treasure revenues from vodka and lack of earnings from beer.

Data show that beer as a commonly used beverage was overshadowed.

Besides, it was a period of social and economic backwardness, low level of industrial development, poverty and low purchasing power, as a result brewing industry couldn’t develop greatly.

So, in 1913 world beer production was 294,7 mln. hl. and the share of Russia – 11 mln., the USA – 77 mln., Germany – 68, England – 58, France – 16 mln. hl.

By the beginning of the first imperialist war, from the moment when czarism had to stop beer and vodka trade, there were 1016 operating plants (within USSR – 845 plants in 1940); 398 of them were in cities and 447 – in countryside (mainly in the Baltic States).

Also, fiscal policy had a negative impact on alcohol consumption. Key figures showing a price level for beer in comparison with prices for the other beverages in Czarist Russia are worth mentioning.

In 1913, one proof spirit in the beer bucket was 30-40 kop. For example, a price for grape wine in the same year (proof spirit 10-12) was 20-40 kop. and in wine-producing regions it was cheaper.

Moreover, in 1913, one proof spirit in a bucket of vodka was 21 kop. All treasure expenses, including production, transportation and retail sale were by three times lower than a selling price for average 1904-1922. Net profit for a bucket of vodka was 250% to its cost.

So, one proof spirit in vodka cost 31 kop., in beer – 30-40 kop. and in wine – 20 – 40 kop. Therefore, vodka was cheaper than beer and wine. Vodka monopoly brought huge revenues to the State and the Czarist Government stimulated expanding of vodka in unlimited volumes.

It is worth mentioning that small production and consumption volumes in the Czarist Russia were caused by a low level of industrial development. In 1913 urban population was only 15% of the total and public revenue per capita was 101 rub. per year.

Dear colleagues, according to our analysis, beer legislative regulation, including excise taxation in Czarist Russia was rather complex and puzzled. This process reminds current problems. So, our history is worth studying because any way you slice it “experience keeps a dear school, but fools learn in no other”.

We’ll continue to discuss this topic in our new analytical article in February 2015: Vodka vs beer: history of struggle. “Part Two: The Soviet Union – Modern Russia”.

No comments